Carbon Taxes in Spatial Equilibrium

Abstract

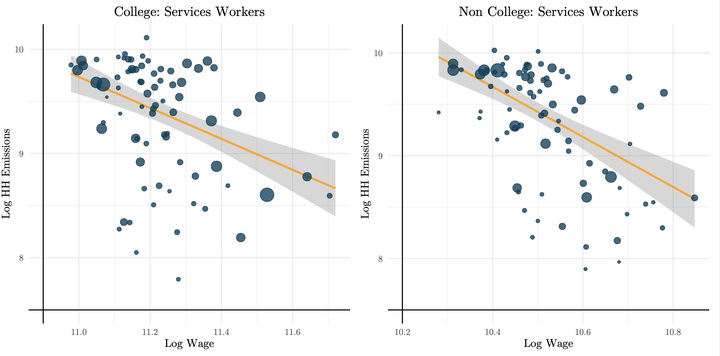

Residential, industrial, and commercial carbon emissions vary substantially throughout the U.S. This variation is primarily due to differences in industrial and residential energy consumption across cities. Recent empirical evidence suggests that carbon taxation differentially affects wages across sectors. To assess the spatial and sectoral equity-efficiency tradeoff with carbon taxation, I develop and estimate a quantitative general equilibrium model. After estimating the model’s structural parameters, I simulate various carbon pricing policy regimes. The model separately identifies two effects of carbon taxes on wages: direct effects (via output reduction and input substitution) and indirect impacts (via workers sorting across cities and sectors). Preliminary results suggest that the burden of carbon pricing disproportionately falls on low-income individuals with significant heterogeneity across cities and sectors.